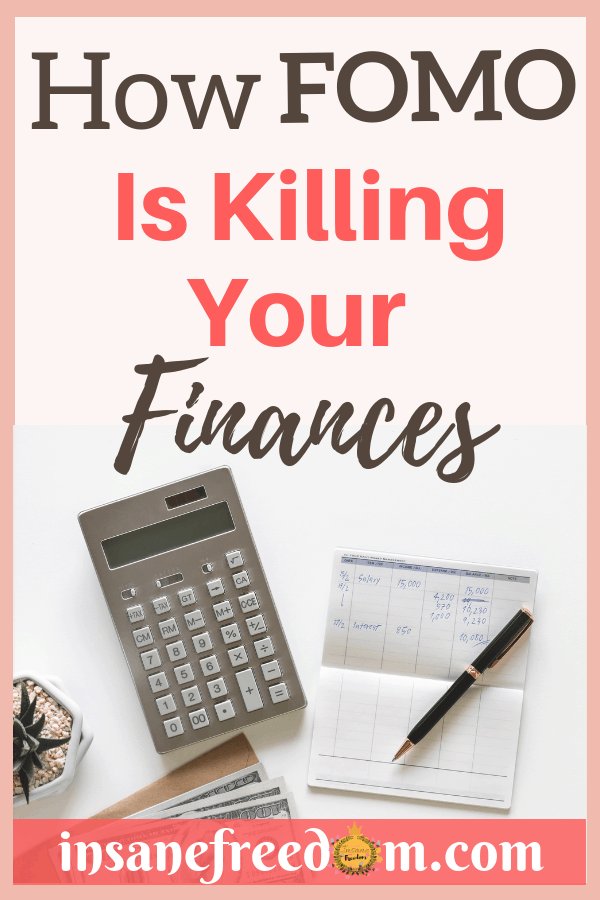

We've all been there. I'm sure you're familiar with it: the fear of missing out. The thing that makes you say ‘yes' to outings and shopping sprees when you can't really afford it.

According to this new survey by Credit Karma, nearly 40% of millennials are going into debt just to avoid FOMO(Fear Of Missing Out). Spending money you don't have to keep up with your friends can be a very expensive exercise. So how can you avoid FOMO spending and start saving money instead?

THIS POST MAY CONTAIN AFFILIATE LINKS. IT MEANS THAT AT NO ADDITIONAL COST TO YOU, I MIGHT MAKE A COMMISSION FROM YOUR PURCHASE. I ONLY RECOMMEND PRODUCTS AND SERVICES I HAVE PERSONALLY USE AND LOVE.

What is FOMO spending?

Contents

It's not a surprise that millennials are the most vulnerable group when it comes to succumbing to FOMO.

They are the ones who use Instagram heavily, causing them to constantly compare their lives with their peers. This CNBC article coined “FOMO spending” as the new form of Keeping Up With The Joneses.

Instead of buying luxury items, millennials are more likely to overspend on expensive experiences.

Going on an expensive holiday and doing extreme sports such as jet skiing and skydiving are what millennials do because YOLO(You only live once!). They are also the most likely to “compete” silently with their peers by using credit cards to fund an “Instagram-worthy” lifestyle. In other words, they are pretending to live the life they can't really afford!

Related articles you might also like:

How Is The Fear Of Missing Out Killing Your Finances

So how exactly do people succumb to FOMO, and why is it so powerful?

FOMO takes hold when people allow their insecurities to cloud their judgement. Without discipline and solid money habits in place, anybody can become extremely vulnerable towards FOMO.

According to this article, FOMO is making millennials poor as 53% of them pay attention to how their friends spend their money instead of how they save it.

The best thing you can do to avoid FOMO spending is to have a budget. If you want to start saving, understanding the purpose of every single dollar you have is CRITICAL. Setting up a zero-based budget isn't difficult! Keep reading on how I started using this simple but effective budget to avoid myself FOMO spending.

Zero-Based Budget To The Rescue

Have you ever heard of the zero-based budget?

Before I built a solid financial foundation, I've never heard of the zero-based budget. So what is it?

Think about the money you have as your army. Instead of letting your money run away from you every week, creating a zero-based budget is a DETAILED spending plan for every dollar you earn. In other words, your money is your minion. This amount is for groceries, the other for rent and so on.

One of the greatest myths about budgeting is that it's for wealthy people. Well, nobody really says it that way but budgeting is nearly always put on the back burner. Have you ever found yourself saying these:

- I will start budgeting when I make more money.

- Budgeting only reminds me of how poor I am.

- A budget won't make me any richer!

Don't know how to create a budget? Grab your FREE copy of the FOMO Budget planner here.

How The Zero-Based Budget Can Protect You From Overspending Due To FOMO

Okay, so how does any of this help you avoid spending money because you have a serious case of FOMO?

If you have a monthly zero-based budget, you are safeguarding yourself against falling under the spell of FOMO spending. Let's talk about the zero-based budget in a more detailed manner.

Let's say you set a weekly budget of $200. For every dollar in your budget, by the end of your week the total income minus total expenses must equal zero.

This is where the zero-based budget can also help you to save money. Within your budget, planning a certain amount of savings ensures that you pay yourself before you start spending money on necessary expenses. Most people make the mistake of paying for expenses, doing some FOMO spending AND THEN LASTLY, saving some money into their bank accounts. More often than not, by the time that happens, there is no money left.

How To Avoid The FOMO Trap

So, you're desperate to stop spending another dollar because of the devil on your shoulder: your FOMO.

Now I'm not going to tell you to suck it up and work on your weak willpower. At the end of the day, willpower diminishes. That's the time you're most vulnerable and likely to overspend.

Build a wall against the FOMO trap by investing in good money habits. What kind of good money habits makes you less susceptible to keeping up with the Joneses?

I'm a huge believer in starting small. Most of the time, we procrastinate on important things because they seem too hard to handle. A bite-sized action plan is better than having massive goals but never having started.

Here are 5 things you can start doing today.

- Be honest about your financial situation

- Record your spending habits, on pen and paper

- Invest in a good personal finance education( and yourself)

- Turn off social media or do a digital detox once a week

- Keep track of your progress and reward yourself

Honesty Is The Best Policy

When it comes to avoiding FOMO spending, being honest about your current financial situation with your friends and family is the first step. Communicating up front about your financial hardship or difficulty will actually help you, not harm you.

Being honest about your financial situation actually helps your friends to open up about their own financial situation. Chances are, if you're keeping your financial struggles secret, your friends are doing the same too!

There's no need to spend extravagantly with your friends just to have a good time. Here are a few suggestions of mine when it comes to sticking to a budget when you're out with friends:

- Communicate clearly on who is paying for what

- Brainstorm free activities you can do together

- Leave your plastic at home. Limit your credit card usage

- Unplug from social media when you're tired or stressed: go for a run or do some exercise instead

- Get an accountability partner: have a budget challenge with your buddy and keep each other on track

Talking about money with your friends and family is an important step towards gaining more control over your spending. Otherwise, you'll more likely end up like our minion friend here!