Ask yourself this honest question, how long can you survive something as devastating as the COVID-19 pandemic without a job? If the answer is “not long”, it is time to learn some harsh money management lessons from the pandemic!

Long before this pandemic-induced economic crisis and recession, many Americans were living pay check to pay check with little to no savings for emergencies.

Although spending money due to the fear of missing out(FOMO) is one of the reasons many live beyond their means, a lack of money management skills including budgeting and paying yourself first among the general public has created the perfect storm for our current economic crisis.

With half of lower-income Americans having lost jobs and significant amount of income due to COVID-19, this study shows that only a staggering 29% say they have enough emergency funds that will last them for 3 months.

7 valuable money lessons from the pandemic

Unlike the Great Depression, the COVID-19 pandemic brought about complete shutdowns of businesses and loss of jobs that are unprecendented. Although there are definitely similar money management lessons from both historical events, there are 7 valuable money lessons the COVID-19 pandemic has taught this generation.

Some of these money lessons you will find from money-related idioms with advice that still rings true today. To help you remember these money lessons, I have included some sayings and quotes below you can save for later!

1. Give more value to monthly income

~It is as useful to save money you already have as it is to earn more.

The most important pandemic money management lesson this generation will never forget is living below your means. With 41 million job losses, this economic devastation is on a scale that is unprecedented. In fact, it is one that generations to come will have to pay for dearly, both financially and personally.

Due to the current economic climate, it is VITAL for everyone to start saving more and spending less. In fact, the more value you give to your money, the more you will further secure your future financially.

2. get health insurance coverage

The latest report from The Washington Post reveals that the number of corona confirmed cases in the USA is more than 6 million in the USA. Now is more important than ever to get health insurance cover for you and your family. Health insurance cover will save you from burning a hole in your pocket when medical emergencies arise.

Health insurance companies are dedicated to helping the Americans by providing health insurance coverage amid the COVID-19 pandemic. The health insurance companies are providing emergency services like testing and treatment to control the current situation.

Better to opt out of health insurance coverage now. It will protect you as well as your family.

3. Build an Emergency Fund: your first line of defence

COVID-19 has not only shattered our health sector, but is continuing to badly impact our economy and exacerbate our already high unemployment before the pandemic. As a result, over 24 million people are unemployed across major sectors, including the hospitality, retail, business and education services.

Without an emergency fund, the economic devastation can negatively impact both your mental health and relationships. As you have to keep paying for essential expenses such grocery shopping, utility bills, etc. , the financial stress of not having enough money to tie you through the next month or week becomes even worse.

Dave Ramsey coins the importance of having an emergency fund perfectly in this quote:

‘Emergency funding is not an investment, it’s insurance with one purpose- to protect you and your family.' Dave Ramsey

Firstly, keep in mind that you should have at least 6 months to 1-year of expenses saved up for emergency purposes. next, open a high-interest savings account and start saving your money designated for emergency purposes. Online banks can be your best bet now with an average of 1.00% APY to 1.21% APY for the savings account.

The Emergency Fund will give you much-needed time to think about your next course of action.

4. Adopt an asset allocation strategy to protect your investments

The asset allocation policy is an important money lesson that coronavirus has taught us. It can provide a protective layer to your investments. Asset allocation means you are distributing your investment among various sectors like the stock market, REITs, commodity market, equity market, etc.

Besides, if asset allocation is done wisely, it will drastically reduce your investment-related-risk. When the stock market shows inconsistency, then you will be saved by the commodity market, equity market, or the REIT.

You should examine your age, income, expenses, your assets, your liabilities, your future financial goals; and after that plan asset allocation for your investment portfolio.

Well-designed asset allocation can lower your investment risk and may provide you with higher returns. No matter the condition of the market, there will always be a protective layer around your investment.

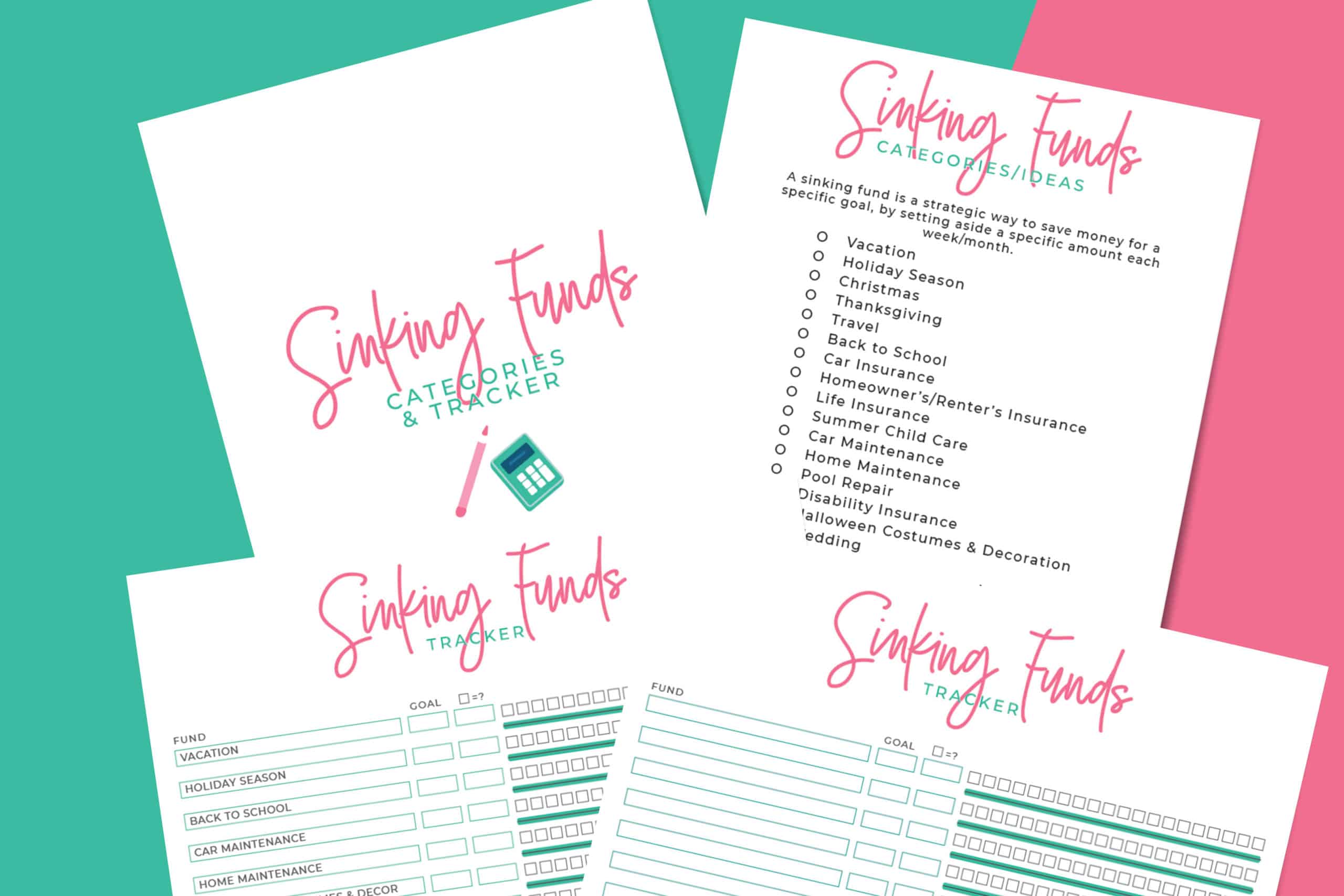

5. budget, budget, budget

Budgeting as a way of life is an important money lesson the pandemic has taught us. Having a budget means that you are keeping track of your earnings, spending, and savings. Not only will your budget give you a safety next should another financial emergency arises, mastering the art of budgeting also lays a great financial foundation for your future.

If you are a beginner, consider these 2 easy and popular budget strategies.

- Zero-based budget: The Zero-based budget is ideal for controlling any distress situation. The Zero-based budget starts with the zero-base. Every need and cost is analyzed under the Zero-based budget.

You have to write down every cent that you have spent. In a panic situation, the Zero-based budget is ideal.

2. The 50/20/30 budget rule: If you want a budget rule that will be easy to use without any glitch, then the 50/20/30 budget rule may be ideal for you.

The budget theory was proposed by Senator Elizabeth Warren, a Senator from Massachusetts. She invented the budget formula for after-tax-payment money.

Basically, you should divide your after-tax income into 3 equals parts.

Specifically, allocate 50% for primary expenses, such as the grocery bill, utility bill, rent or mortgages etc. Next, put aside 30% of your money for luxury and entertainment, i.e. having a night out at the movies, dining out and shopping.

Lastly, assign the remaining 20% towards savings and investments. Your savings is for the future, so refrain from using it to pay the bills and impulse spend on things you do not need.

If you maintain this budget consistently, there is very little chance you’ll ever face major financial problems.

6. Diversify your income streams

Another great money lesson the pandemic has taught us is the dangers of relying on ONE single income stream! The rise of the gig economy and the lack of full-time employment in the past decade proves having multiple incomes is crucial. In fact, you should never depend on a single source of income, especially with the ever increasing cost-of-living.

If quitting your job is not an option, consider picking up a side hustle or two to supplement your income. Whether it is side hustles you can start without any money, or online jobs that pay weekly, there are definitely plenty of options.